tv Squawk on the Street CNBC January 3, 2013 9:00am-12:00pm EST

9:00 am

think. was the beatles on any part of the list? i'm only sleeping? i -- the retailer is posting lower-than-expected quarterly profit. the emphasis on selling more every day items such as cigarettes and soft drinks put pressure on margins. >> let's get back to our guest host, judd gregg, you have the last word. off last word? we have a little game here. >> i saw where the market, went up dramatically yesterday, i think it's a sugar high because of the fact that we haven't solved our underlying problem as a nation. when we do solve it, when we do get our fiscal house in order, get ourselves on a path -- >> goldman sachs? >> excuse me? >> are you saying this as a goldman sachs man, you think the market's going to go down? >> they are too smart for me to tell me what they're going to say but my view is the markets are never going to be comfortable until we get our fiscal house in order. >> i don't know if they will ever be comfortable. >> judd, thank you very much. >> a pleasure. >> great having you. join us tomorrow for jobs

9:01 am

friday. right now, it's time for "squawk on the street." good morning, welcome to "squawk on the street," i'm melissa lee with jim cramer and brian sullivan. carl quintanilla has the day off. what we saw yesterday earthquake the best day for the s & p and the nasdaq over a year. data out to contend with, an adp number in december, jobless claims, may be taking a breather in today's session, the dow looking to lose about 33 at the open. take a look at the picture in europe. does also look like europe is taking a breather. yesterday, it is worth noting the stock indices there hit 17-month highs. we are seeing a down day almost across the board a road map, starts with the new year's rally, where we go from here. the dow surging more than 300 points, closing at two 12 1/2-m

9:02 am

highs yesterday. leadership from technology and financials, a boost today with upgrades. lots in the coming days. the big jobs report tomorrow. oh, yeah, the battle over the debt ceiling and spending cuts. retail do-or-die, december sales are out. standouts include costco, nordstrom and the gap. misses, target and the limited. starbucks wants to you recycle, selling reusable cups for a bunch the chain announcing its latest location in vietnam. brian? >> after a 2% rally yesterday the markets are set to open a bit lower on profit taking. investors worry the fiscal cliff deal merely a band-aid on the broken leg of deficits and we will have major fights ahead. dow few. churg falling .3. s & p, .8. hardly a dramatic turn from yesterday. those adp nba numbers, 53 above the consensus forecast.

9:03 am

that was a big number, adp. >> huge. huge. >> i don't know how much the fiscal cliff discussion cooled the steam but there's a mixed picture, not a negative picture on retail. i thought that many of these companies were going to put discipline, but target was good, not bad and ross stores good and macy's not that bad, maybe kohl's down. i thought to be coming here and every single one of these retailers would bemoan things. it is business as usual. not bad. >> stocks go up one reason, more buyer than sellers. filter away all the noise, the reason stocks go up. my question is, and it's a good place i guess to ask it, who were the buyers yesterday? were they individuals coming back in? were they hedge funds? were they institutions playing the short-term momentum? do we know? >> i think there's always money coming in the beginning of the year, contributions to be made, and i think a lot of sellers a

9:04 am

remorse, people that sold stocks, they have been sold down relentlessly. let's not forget, people who genuinely felt that things were going to go totally awry over the weekend, nothing would happen and get a great opportunity to buy much lower, didn't happen. they came in. i don't like to buy up 2 or 3%. it has not worked in 33 years. for me, always one or two exceptions. i don't think this is an exception. >> the way the rally played out yesterday was everything you could hope nor, started out strong, pulled back off the highs but finished very strong. we had some decent volumes and leadership from the groups that led us higher in 2012. wasn't a rotation. people saying, you know what i still believe in the financials, i still believe in technology and going to after 2013 with those sectors overweight. as for your question, i don't know if we will know that answer in terms of the mix of the institutional versus the retail investor at the end of the day. i don't think we can have that break down. >> maybe find out in the next few days. >> yeah.

9:05 am

yeah. >> i don't think it is such a great idea to come in until we know more about how companies are doing. we have earnings next week. i don't think earnings will be that great. be aware, you have to have a level of confidence if you are buying here that can be -- you can not be shaken out. if you are buying right here, by what will probably be just some okay quarters. >> i'm going to take a page from our good friend herb greenberg's playbook and hopefully he is watching, i will taken a opportunity to praise and bash him at the same time. praise him because he tends to be right about a lot of things, except jcp, he owes me dinner on that >> yes, he does. whaefrnlts does say, true this quarter this is the most important he were,s season, you know, of the year. this might be because of the guidance for the full year that we hopefully will hear from major companies. what are they expecting for full-year 2013? >> i guess so would you really take -- take the guidance at face value, a guidance given in january of 2013 for the full year january 2013 when we still have the southwester to deal

9:06 am

with? >> i hear what you are saying but it's all we got. we don't have anything else. >> wasn't herb tweeting about cold weather today? i thought you were gonna to -- >> once it goes under 65. >> i was trying to fathom that tweet. waiting for a herbalife tweet, but instead got herb. >> we louvre, herb. >> finally, he is right. finally, a broken clock, brian. >> finally. the feet pajama thing he is doing that is fine, too. >> in term of the various things investors to deal with on earnings, two important numbers on job, adp saying companies in the u.s. added 215,000 workers in december, more than predicted. the increase is the largest, in fact, since february, jobless claims rising to a seasonally adjusted 372,000, but the data continue to be distorted by the holidays, this is ahead of tomorrow's big report from the

9:07 am

labor department. and i think a lot of investors might be looking that the report a little more carefully simply because last fed meeting, they are pegging their interest rate strategy to the number, to the rates number. >> the fed is -- we have been saying, look, look, 6 1/2% unemployment, we may never get to there. the fed wants very much to stay loose. i really wonder where the bonds would be in going to this debt ceiling discussion, possible default, if the fed weren't in there buying it. >> which is sort of our comment yesterday about the bond u nix, as i'm calling them, they don't have that opposing force anymore in the economy to right the ship, if you will. i guess if i want to say the bad news is good news scenario, you're right about the fed because if tomorrow's number comes in hugely positive and we keep inching down, at some point, the market will make that seismic shift to anticipating higher rates, perhaps seen than mid-2015. >> that's what i think.

9:08 am

why this might be the most important jobs report. >> the most important earnings season and most important "squawk on the street." >> i remember the old days, come in and alcoa and reynolds bad. femmes dodge, excuse me for dating myself, they would come in and you would think, well this is going to be the big cyclical rally, fourth quarter, everyone excited, bulled up about them, and slashed numbers, slashed number also you can would just be sit there used to go to disney world every year my kids, on that pay phone near it's a small world after all. it's a small stock market after all. just cutting numbers. i want to be braced for that i want to be braced for number cuts. >> they might be coming. tomorrow is the big december jobs report so that means another opportunity for you to nail the number. so tweet us. people on the slow not qualified to join in. is that what -- i thought -- >> with the boo-yah. >> tweet us the plea dictions for the non-farm payrolls

9:09 am

number, at squawk street. the number, #, the number, this month's prize is this thing that jim is signing right now. wow. >> give me that. all my love, carl quinn tin nil la, my home phone number. >> sign is it with a k. >> here is my cell phone, please sex me. i'm not going to put that in there >> jesus. what are you saying? >> hopped up on cold medicine. could i not sleep last night. office complete wreck. my head feels like -- >> this is a notebook, by the way, one minute before the friday release of 8:30 eastern time for all the rules. stocks at cnbc.com. not competing against any of us, not that we have insight, except for jim. >> none whatsoever. >> he has signed this thing and all going to sign it by the way, including rick santelli out in chicago. worth entering for. >> all right. retailers reporting a mixed bag of december sales figures today after a rough holiday season.

9:10 am

costco standing out with numbers atop expectation, reporting a 9% increase in sales. gap and macy's topping estimates, target came in flat, we can debate that. limited brands well below expectation. you said target wasn't as bad as some people are saying it is this morning. >> yesterday i said the street was thinking target and ross stores would be bad. they turned out to be not as bad. they go higher. gap was actually very good. the dollar stores remain under pressure and there is, to me, margin pressure in that part of the industry. i wonder whether the payroll tax will not help them, the dollar stores, walmart very aggressive. the idea a lot of these companies should to stop reporting monthly numbers, it is a hedge fund ritual to trade them in and out. family dollar's earnings not that good. >> if you were the company, would not want to report the numbers. >> they should stop doing t.

9:11 am

>> an investors, a great read. macy's -- what's troubling about macy's it is a perennial favorite among wall street analysts, always a favorite, execute very well, et cetera, et cetera, et cetera. they missed, took down fourth quarter. saying their forecast for same-store sales for the fourth quarter also fall below expectations. what happened here? it seems like there may be a shakeout going on in terms of retail favorites. >> could the department stores look weaker. we had a lot of warm weather. also the terrible tragedy, sandy hook did i think crimp holiday sales. let's not forget macy's another one people thought it would miss and it didn't miss. there was an expectation that things would be bad, you will have some of these stocks popping. yesterday, by the way, costco people thought would be good. cost coe not popping. the quarter is the best way to grade a ceo and company,

9:12 am

retailers put a gun to their heads with these monthly numbers. i don't blame walmart one bit for trying to get out of that game t is not an easy game to play. gap, good acquisition, intermix, raising the level of what they want do gap's doing so many right things. i just -- >> turnaround only took a decade. >> rein wasn't built in a day partner. unit thing, going with your -- >> not forget the coast of jeggings past, right? supposed to -- your kids are older than mine, mine is 9, the difference in the performance companiless i would perceive to be similar, all due respect, aeropostale and abercrombie & fitch, from my untrained heathen eye look similar in terms of the product mix, you luke at results, they are very, very different. i guess that's where the operation, where management matters.

9:13 am

>> i got a gift certificate for made well, a j crew outfit, my daughter says made well, nobody uses. made billion? a few months later, she wanted to work at made well. >> in terms of limited brands quickly, bath and body works, very strong, weakness at victoria's secret, comps very tough. also something to keep in mind with a lot of these retailers, last year's numbers pretty good. comparing against tough conversation. last december was up 11%. victoria secret. so no surprise, very tough to lack those conversation. >> pay attention month over month, quarter over quarter rather than year-over-year. >> at least you didn't go talking about buying something. the track you are on, cold medicine wise you reveal you didn't shop there this quarter and that's what changed the numbers.

9:14 am

>> i didn't shop there this quarter, nothing at victoria's secret on offer for me. >> thank you for just being out there >> do not make my size, a quadruple xl. >> went back into it again p >> see if he would grab it, you know? >> what an image, i'm trying to -- >> thank you. >> as soon as it came in. >> up next, starbucks reduce trash and how it could save you money u and gary kaminsky is back. what is a prominent bond investors saying about the debt ceiling today? another look at futures again, taking a breather off of yesterday's big rally, the s & p looking to back off by 1.25 points. stay tuned. [ male announcer ] how do you trade? with scottrader streaming quotes, any way you want. fully customize it for your trading process -- from thought to trade, on every screen. and all in real time. which makes it just like having your own trading floor,

9:15 am

9:17 am

starbucks kicking off a new green initiative in stores today to cut down on rasch. the coffee chain is rolling out this, a $1 reusable plastic cup sporting, what else, the starbucks mermaid, looking similar to the paper version you can see, a little bit harder. the cup will be available at all company-owned stores in u.s. and canada. stores will give a 10 cent discount for every refit they will be cleaned with boiling water every time, don't have to be cleaned yourself. that is a big deal for me, somebody to clean the cup, i'm more likely to use this. what do you think about this? >> look, i got to get religion about it, frankly, my kids don't even like to use plastic

9:18 am

bottles, they use that clorox filter, britta filter. i have one that's ceramic that martha stewart gave me and i have not been using it, maybe this will be a change for me. >> will it help sales? >> not going to impact eps. >> i would think soon. more importantly, coffee and the price of coffee. did you know could have if i was the worst-performing commodity last year? arabic ka down, robust toe down. >> a reduction in the beans but

9:19 am

no reduction in the coffee store at starbucks. >> i use the $60 price target jim crimer on twitter. >> oh, 60 bucks. that's nice. let's move on here, what goes together than spam and peanut butter? >> everything. >> it's true. hormel says it will buy the skippy peanut butter business from unilever for $700 million. skippy ranks as the leading brand in china and sold in 30 other countries and five continent he is. hormel expects skippy to modestly add to its 2013 earnings. the backdrop is last quarter, hormel posted weaker-than-expected earnings. maybe this will turn it around. >> i think b and g foods, heaping skippy would get that, b and g bought cats and dogs from own lea unilever. the peanut butter business is good, not great r i remember two years ago, jim seine national,

9:20 am

former ceo at costco, a dissas route crop, a little bit of you what i regard commodity worry with hormel beyond just beef. who are smell well run, a very long, established dividend policy and positive for them. >> did you know peanut butter around gelly is the number two sandwich in the united states behind ham? who are me, make other africaned ham like product. >> after thermonuclear war, there will be roaches and there will be spam.

9:21 am

>> is there is a small biofuel aspect to rendering, rendering the fats, you can burn fat and you get a tax credit. thank you congress. >> i learn every morning from you. and also at 2:00. >> thank you for the tease. appreciate that 2 a.m., you mean. >> how can you keep the new year rally going in your port folio? the ceo of nutrisystem, how much heft will new year's resolutions add to the company's bottom line? and take a look at futures one more time, we head to this with the dow give up 29 at the open. more "squawk on the street" straight ahead.

9:22 am

people really love snapshot from progressive, but don't just listen to me. listen to these happy progressive customers. i plugged in snapshot, and 30 days later, i was saving big on car insurance. with snapshot, i knew what i could save before i switched to progressive. the better i drive, the more i save. i wish our company had something this cool. you're not filming this, are you? aw! camera shy. snapshot from progressive. test-drive snapshot before you switch. visit progressive.com today. tdd#: 1-800-345-2550 when i'm trading, i'm so into it,

9:23 am

tdd#: 1-800-345-2550 hours can go by before i realize tdd#: 1-800-345-2550 that i haven't even looked away from my screen. tdd#: 1-800-345-2550 tdd#: 1-800-345-2550 that kind of focus... tdd#: 1-800-345-2550 that's what i have when i trade. tdd#: 1-800-345-2550 tdd#: 1-800-345-2550 and the streetsmart edge trading platform from charles schwab... tdd#: 1-800-345-2550 ...helps me keep an eye on what's really important to me. tdd#: 1-800-345-2550 it's packed with tools that help me work my strategies, tdd#: 1-800-345-2550 spot patterns and find opportunities more easily. tdd#: 1-800-345-2550 then, when i'm ready... act decisively. tdd#: 1-800-345-2550 i can even access it from the cloud and trade on any computer. tdd#: 1-800-345-2550 with the exact same tools, the exact same way. tdd#: 1-800-345-2550 and the reality is, with schwab mobile, tdd#: 1-800-345-2550 i can focus on trading anyplace, anytime... tdd#: 1-800-345-2550 tdd#: 1-800-345-2550 ...until i choose to focus on something else. tdd#: 1-800-345-2550 all this with no trade minimums. and only $8.95 a trade. tdd#: 1-800-345-2550 open an account with a $50,000 deposit, and get 6 months commission-free trades. tdd#: 1-800-345-2550 call 1-877-994-7694 tdd#: 1-800-345-2550 and a trading specialist

9:24 am

tdd#: 1-800-345-2550 will help you get started today. coming up, a huge day yesterday, 6 1/2 minutes away before the second opening bell of the year. begin with a fruit cup, apple, a lot of people love to trade, a rough couple of months. what are we hearing? >> i think very, very good at bernstein, been on street signs, tony is saying stop trading it. going to be choppy but over the

9:25 am

long term, going to go up. he has a terrific line here, transition from a hyper growth stock won't be easy and has been reflected by the recent swoon in apple shares some he is saying this whole thing is the transition, trying to figure out how long he can grow over time. >> not saying don't buy it saying don't trade it? >> don't trade t >> he thinks you should own it, right? >> right. what happens is a lot of people whipsawed by apple. i think he is addressing it, saying this is a company he still likes, still outperform, keep the target price 750. obviously, target price 750, doesn't want you out of it but recognizes, look, it's going to be up and down, up and down, stay the course. blast yourself to the apple mast. >> citigroup a dual upgrade irk not the biggest sell side firms. >> we don't talk about that enough there are -- jmp likes citi. we remember the old days much,

9:26 am

much higher, divide by ten year. these are stocks tough make. come in today the wrong employment number and earnings, i'm arguing for caution in the bank group, really hot in the fourth quarter. i do like the group, no reason to pay out. >> move on to health care, easy to forget that united health group is a member of the dow. >> dow jones average. >> unh and competitor, wlp, taken down by deutsche bank today. >> remember when these were darlings? people couldn't get enough united health? these are employment plays. i have to tell you while i like them, you think the job growth is not going to be great, we don't know, a lot of uncertainty, solve one part of the equation with the taxes, you got to stay away from united health. >> these are jobs stories, your view? >> although someone says automatic data is good today. we saw good job numbersle. when i see the numbers, people taking these stocks down, that's

9:27 am

about job growth, it's not about obama care. >> jc penney? >> deutsche bank says don't like it. i bought a hat there a couple weeks ago but i lost the hat. >> help jim find his hat. which chain stores will be the biggest gainers today now that the december sales numbers are out? that's your question. stick around for the answer. and one day after jim said ford could be the s & p's best performing stock of this year, all right automakers get a lift from december seams? those numbers also due out all day long. a lot to do coming off a huge run yesterday. don't you go anywhere. opening bell, more "squawk on the street." we are going to look for jim's hat. we are back after this. there are a lot of warning lights

9:29 am

and sounds vying for your attention. so we invented a warning you can feel. introducing the all-new cadillac xts. available with a patented safety alert seat. when there's danger you might not see, you're warned by a pulse in the seat. it's technology you won't find in a mercedes e-class. the all-new cadillac xts has arrived,

9:30 am

and it's bringing the future forward. ♪ [ indistinct shouting ] [ male announcer ] time and sales data. split-second stats. [ indistinct shouting ] ♪ it's so close to the options floor... [ indistinct shouting, bell dinging ] ...you'll bust your brain box. ♪ all on thinkorswim from td ameritrade. ♪ [ opening bell ]

9:31 am

>> [ inaudible ] >> what an amazing two-day run we have had. this san interesting stat from dan greenhouse of btig, better than all but 1% of two-day rallies since 1990. so, very, very strong performance here, taking a breather at this point. >> we know the thoughts, too all that data how you make money in stocks over the long term and don't quote me on the exact number, something like one quarter of all lifetime gains come in 90 trading days over 30 years, right? in other words, if you are out of the market at the wrong time, you miss one or two days, it's gonna skew your long-term returns forever. >> the great peter lynch, magellan, always been his thesis, he said people want toly if the -- want to flit in and

9:32 am

out, he said the only way to get the compound dividend it is, it was too hard. he was the mast per and he couldn't do it who else? >> pmi, the best rating in a while. the euro weakening against the u.s. dollar, watch thanksgiving yesterday, continues to trend today. there is a bid to safety in today's session. i hate to use that phrase you to put it simply, the safe havens out there as we are staring down the barrel dealing with the debt ceiling and spending cuts. >> i thought they would have a tailwind rather than a headwind on currency. not in sync with a bullish picture, got to understand that

9:33 am

one of the great reasons we have been able to have a good run, the dollar getting weaker. and also, unless people are short today, i know people are short, nordstrom's very heavily, short target, short gap, that is the only thing really going up. the mean time, i keep pointing out these dollar stores, they are horrendous today. family dollar really terrible. >> family dollar down 12%. >> you have nordstrom going higher, family dollar going lower, people felt that maybe the dollar stores would catch a bid and nordstrom would have weakness because of the high-end consumer being worried that clearly has not been the case. >> we are seeing some strength in the home builders today, but financials, we mentioned analysts coming out, particularly citigroup, on citigroup, trading down a quarter of a percent. but stern agee was interesting because he says that mike core vath is a game changer. he took office three moment ago at this point. the stock has rallied 20% since

9:34 am

then? >> he is undoing a lot what vikram pandit wanted to do. i think it is an undervalued. i think the group is very undervalued. >> what is citigroup? is it a mortgage company? a commercial bank? >> i think it wants to be a commercial bank. >> wells fargo, they want to be a lot of things but the heart of it they are a mortgage company and a bank. i'm talking about lending money, making net interest margin and getting back. still trying to figure out what citigroup is >> >> very difficult situation to figure out. they try to make it the international emerging market bank, changing that view. bank of america, brian moynihan, positive saying we are going to start lending. they have been lending, but turn on the spigots.

9:35 am

be careful with that. >> bottom of your screen, ford sales, december sales, better than expected, 1.9% versus 1.6%. that goes in line to with what you are predicting in 2013. >> being able to cut back the cost in europe, latin america, asia turning around, doesn't hurt. we were up so many points in the last couple of days you don't get really down if we come in a little -- but remember, there are earnings coming out and there was a lot of worry about fiscal cliff going in. we still haven't resolved the spending side one trying not to be myopic and look at just washington but i know the companies are very concerned. they will talk about that on their conference calls. i wish they wouldn't. but they will. >> barns and enable same-store sales, the highlight here is that nook sales for the nine-week period ending on saturday were down 13%. digital content sales were up. but device volumes were down. so, if they can't gain any

9:36 am

traction on device volumes during the holiday period, you kind of wonder when people are going to buy these things. >> amazon looks like it's the winner here. i've got to tell you you amazon, when i look at what's going on with some of these high-end retailer, amazon not up today. amazon has won that war, i guess. a lot of companies want to be in nook and a superior device, often does not matter. people at home say nook, i love it, buy barns and knownle, doesn't translate into better stock performance. >> phil lebeau live with the fords numbers. >> the street asked for gain of 1.6%. most of that coming in the areas where we expected some strength. what's really going to be interesting today, not only ford but all the automakers, look what happens with pickup truck sales, seeing steady growth in that area. in particular, when gm reports at the top of this hour, remember, got a huge backlog of

9:37 am

pickup trucks. how much of that were they able to clear out and how much are we seeing organic growth within demand for pickup trucks. about an hour ago, we had chrysler reporting better-than-expected numbers as well. you have got ford better than expected, chrysler at 10.4% increase versus 7.3% being the estimate. are we setting ourselves up to see december come in as the best month in terms of a sales rate this year? november is the previous best coming in at just under 15.5 million. many are saying we are probably going to be in the 15.3 range. don't be surprised if we do top that number, given that we are starting to see better-than-expected numbers so far today. guys? >> so bullish. so bullish. auto's good. >> listen, you guys note markets, i know cars, right? cars a big part of my life, a long-time -- >> corn, car? what is it you don't know? >> ford, what they have done, i was looking last night actually, list the 100 best-looking cars of all time, one guy's opinion insider, the fusion, the new

9:38 am

ford fusion was on there. >> really? >> the focus on many best of list. ford has probably done a better job than any major company at changing the image of that organization. i just mean that from a driver's perspective. >> i recommended last night on mad money, exactly, this -- and by the way, the four -- the 150, 250, 350 never lost their luster ever. bought a 350 used, now 2011, spectacular deal, worked with my friend, michael haley, helps run an inn that i own in summit and i just think the brands here are great i also think that al mulally determined to get the stock. mulally cashed in the options, took a lot off the table, but i think you are right. reinventing ford still. >> i think the sad part about the auto business, we focus so much the last few years on debt and health care around unions and bailouts. at the end of the day, having a product that incites passion and emotion when you look at it, that it's visually stunning to you, that's all that matters. >> race cars. and you race cars?

9:39 am

>> i race a ford-powered car. no connection, just saying as an individual, done a great job. the cars look good. >> our thanks to phil lebeau, certainly a lot of other auto sales numbers coming out. bring them to you when we have them and phil's interviews with executives for the month of december. check in with bob pisani here on the floor with what is moving. like the celebrity toiv market technicians all here today. >> looking around, waving to some of these guys, i have known for the last several years and nice to see them. of course, technicals have become more important than ever as more people get involved in the market and become uncertain on what they should be doing. technicals offer a very clear in and very clear out for a lot of people. let's talk about what's going on. have you noticed that rally yesterday, didn't take long for that to end, he did it? now everybody trying to figure out about the continuing minifiscal cliff, some people are calling t can we agree on one thing? can we get rid of the phrase fiscal cliff? trying to find a different one.

9:40 am

so 2012. bank of america, merrill lynch, ethan harris' team, they are calling it the three gorges. the sequester, the debt ceiling and the resolution around the fiscal 2013 budget. i don't have a better phrase. three gorges, go with that now. the retailers, pleasantly surprised with what i saw for the retailers, caveat. december same-store sales were up 4.8%. that was before expectations, 3.4% and remember, the numbers have been coming down in the last few weeks. i was surprised more than half beat the numbers, that was nice. great numbers overall. gap, ross stores, tjx, costco, nordstrom and macy's, all beat. here is the problem here, the storms were really a problem. big midwest storms, storms in the northeast a after christmas a problem, the fiscal cliff talk held retailback. i count seven companies that guided lower, two guided higher. i think the reason was bad.

9:41 am

we saw stern agee, apm raising -- bernstein, a couple of them as well. what's hand, banks are the back door play for the housing recovery but now trying to expand that argument, some of the analysts, say banks are the back door play for an improving economy and that's where i start getting a little jittery, talking about sub 2% gdp growth and playing an improving economy. they also are arguing that

9:42 am

consumer is going to be improving overall and reaching the end of the deleveraging process that began in 2008. maybe. but remember, 2% additional tax these consumers are paying in the form of the payroll tax is going to be a drug on consumer spending and problem for the bank. talk about other things, interest rates might be rising. that would definitely help a steeper yield curve. again, a lot of these are assumptions still. i would bet that sub 2% gdp the tougher road to hoe for the banks, since many of them run nicely. bank of america 100% gain in 2012. a tough one to get through in 2013. >> high-end retailer not surprise me. people selling the stock, not surprise me if a hall a very good holiday season if nordstrom's did, macy's did,

9:43 am

costco did. rick santelli at the cme group in chicago. good morning, rick. >> good morning. we know we had two bits of data out today, one adp, better than expected, talk on the santelli exchange around 10:50. the other bit of data, a bit of a rise on initial jobless claims. with the holiday season affecting both and the temporary workers side, fascinating to reconcile these, the way the ten-year did it boom, adp yield moved up, on the jobs, it moved down on initial jobless claims. so now, we are one basis point below the 184 sell yesterday. open the chart up to may 1st you can pick it out, hovering at the highest yield close since mid-september but really, very close. should we get close to 190 or so to comp it all the way back to may. now, all about fx this is fascinating. look at a two-day chart of the euro versus the dollar. wow. the euro has gone from is 133 to

9:44 am

131 a big move. now, look at the dollar yen. granted. it's lost some ground. still at really lofty levels. is it the euro or the yen? let's explain that look at the two-day the euro versus the yen. interesting. that is giving up ground. look at the canada versus the yes. the canada is really holding up well. after looking at all the cross trades, i would think that the euro is really the catalyst for some of the lower trade, even though we all know that the yen is on a path most likely to lose ground against most of the major currencies. brian sullivan, the mario andretti of street signs and "squawk on the street," back to you. >> you're way too kind, rick, but i will take it. thank you very much. let's check out the latest moves in energy and metals and go down to sharon epperson at the nymex. how are things looking, sharon? >> looks like we are seeing a bit of a pull back across-the-board in the commodities sector after yesterday's sharp rally, gold hate two-week high we are

9:45 am

looking at the aftermath of this, a lot of folks deciding now they put new money to work what are they really going to do for 2013? you look at the gold price, it's hit the lows of the session right around where that major support is, 1675 an ounce. again, traders are say a break below that will signify perhaps a lot more selling in the gold market. we are also watching oil prices that are still very near multimonth highs, although we have seen a slight pull back there braent crude prices at a two and a half month high and nymex wti at a three-month high. natural gas prices, the slide there continues, for three straight session and in fact, yesterday's one-day plunge was the biggest one-day plunge we had seen in three years' time when natural gas fell to 3.05. now, expecting to see warmer temperatures in the 6 to 10 and 11 to 15-day forecast, from the private forecaster, wsi and that storage report on natural gas tomorrow at 10:30 a.m. eastern time, a day later because of the

9:46 am

holiday this week. also, oil inventories out tomorrow at 11 a.m. melissa, back to you. >> thank you, sharon epperson. still ahead, general motors outs with the numbers. the vice president of u.s. sales will join us live right after those numbers are released. and jeffrey gundlach's exclusive interview see where he is putting his money in the new year, at 11:40 a.m. eastern time. she's still the one for you -

9:48 am

you know it even after all these years. but your erectile dysfunction - you know,that could be a question of blood flow. cialis tadalafil for daily use helps you be ready anytime the moment's right. you can be more confident in your ability to be ready. and the same cialis is the only daily ed tablet approved to treat ed and symptoms of bph, like needing to go frequently or urgently. tell your doctor about all your medical conditions and medications, and ask if your heart is healthy enough for sexual activity. do not take cialis if you take nitrates for chest pain, as this may cause an unsafe drop in blood pressure. do not drink alcohol in excess with cialis. side effects may include headache, upset stomach, delayed backache or muscle ache. to avoid long-term injury, seek immediate medical help for an erection lasting more than four hours. if you have any sudden decrease or loss in hearing or vision, or if you have any allergic reactions such as rash, hives, swelling of the lips, tongue or throat,

9:49 am

or difficulty breathing or swallowing, stop taking cialis and get medical help right away. ask your doctor about cialis for daily use and a 30-tablet free trial. starbucks want you to kick your disposable coffee cup habit. today, the coffee giant will start selling a reusable plastic cup that resell about bells the paper version for just a doll large the dollar tumbler is the latest effort to cut down on the trash that ends up in streets, landfill and waterways. what is some other trash that needs to be cut down and why? tweet us at squawk street and we will air your responses throughout the morning.

9:50 am

i feel like a lot of snarky, mean things are going to come in the tweet box. >> i have got to get more in the habit of having a bag when guy to the supermarket. last time i go to the super marget, there i was taking those plastic bags, i didn't think ahead of time that is still a tremendous waste. california very tough on that >> some would argue k cups. >> right. huge waste. lots of waste in the k cups. >> a bottle of water. diapers. >> i'm doing that one wrong, too. can all work hard they were issue. >> we can. absolutely. a few market moves worth noting, we take a breather, we rest after the big two-day rally that we have seen, the airline index trading at its highest level since february 2011. the house, highest since december '07 and defense record highs, dfx, a fresh record high. this is the sector in particular that has really defied expectations. >> good yielding, very well run

9:51 am

companies. at the same time, military sequestration you supposed to be on everybody -- just going to fire people. >> right. >> not machines. and on the housing, wow, i mean, this is the rally that defies fiscal cliff, defies government spend. it is about what bernanke has done, low rates and aforward ability and they are still affordable, the rates still low. >> spwr, as we go to break, sun power, lazzard, an upgrade today, $11 price target saying a lot of sales visibility. we haven't heard that a lot from the solar power names, figure, hey, why not have sunshine after yesterday's rally, look at spwr. >> when buffett's utility buys projects from this company, that certainly helps. >> does. look at that gain. >> you talk about decker's. i think vf corps will come in and buy dex. >> prediction for 2013. >> on your prediction list? >> it s. >> don't go any wrarks lot more "squawk on the street" ahead.

9:52 am

>> coming up, come on in the water is -- well, freezing. don't let that scare you, jim cramer will keep you toasty warm, six stocks in 60 seconds, when "squawk on the street" returns. c'mon dad! i'm here to unleash my inner cowboy... instead i got heartburn. [ horse neighs ] hold up partner. prilosec isn't for fast relief. try alka-seltzer. kills heartburn fast. yeehaw!

9:53 am

9:55 am

good morning tour the next hour of "squawk on the street," we will look at the significance of 90% upside days followed by another 90% upside days with the main guy at raymond james. going to kick the tires on a projection that apple could rise 60% this year, talk about retail sales and whether mr. mcdreamy can monetize his fame by buying tully's coffee. an action-packed show ahead. >> six stocks in 60 seconds. their als drug did fail a great company. >> talk about a couple of home builders. >> now upgrades a little bit late but one of the impetus behind the group going up. >> an upgrade for cisco systems. >> i think this is important. i think cisco doing better than people think. taken a lot of share from june per. >> priceline, another upgrade on a stock that's had a gigantic run. >> wow, i mean this stock, i got

9:56 am

to tell you can the last darling standing. >> if william shatner didn't sell, he is a really rich guy. huntsman, hun. >> at this time. o too, it had been coming down in price, saying it could stabilize. >> disaster du jour. >> cfo left right there. you know what ask herb greenberg, all you need to know. a biotech but a data story. >> what you got on "mad money"? >> one of my absolute favorite guests, charisse suing kirk sharon enerson made a great point, so much natural gas in this country we should export t $3 natural gas, a visionary, love him on the show. saying we burn off natural gas than we use. i just think this man has a vision and he is gonna pull it off and he is hiring more people than almost anybody in the country. >> i would like to know fess having trouble hiring, we are heard about that, lack of skills up in north dakota.

9:57 am

and how do you pro-news that? one of those names? >> cheniere. shen near. >> not shlamele, slamazel. -- >> wasn't anything you didn't cover, the yiddish you the race car, the darling. >> thank you, robe -- robe us itten.robitussin. i have a cold, and i took nyquil, but i'm still stubbed up. [ male announcer ] truth is, nyquil doesn't unstuff your nose. what? [ male announcer ] alka-seltzer plus liquid gels speeds relief to your worst cold symptoms plus has a decongestant for your stuffy nose. thanks. that's the cold truth!

9:58 am

we replaced people with a machine.r, what? customers didn't like it. so why do banks do it? hello? hello?! if your bank doesn't let you talk to a real person 24/7, you need an ally. hello? ally bank. your money needs an ally. tdd#: 1-800-345-2550 after that, it's on to germany. tdd#: 1-800-345-2550 then tonight, i'm trading 9500 miles away in japan. tdd#: 1-800-345-2550 with the new global account from schwab, tdd#: 1-800-345-2550 i hunt down opportunities around the world tdd#: 1-800-345-2550 as if i'm right there. tdd#: 1-800-345-2550 and i'm in total control because i can trade tdd#: 1-800-345-2550 directly online in 12 markets in their local currencies. tdd#: 1-800-345-2550 i use their global research to get an edge. tdd#: 1-800-345-2550 their equity ratings show me how schwab

9:59 am

tdd#: 1-800-345-2550 rates specific foreign stocks tdd#: 1-800-345-2550 based on things like fundamentals, momentum and risk. tdd#: 1-800-345-2550 and i also have access to independent tdd#: 1-800-345-2550 firms like ned davis research tdd#: 1-800-345-2550 and economist intelligence unit. tdd#: 1-800-345-2550 plus, i can talk to their global specialists 24/7. tdd#: 1-800-345-2550 and trade in my global account commission-free tdd#: 1-800-345-2550 through march 2013. tdd#: 1-800-345-2550 best part... no jet lag. tdd#: 1-800-345-2550 call 1-800-790-3801 tdd#: 1-800-345-2550 and a global specialist tdd#: 1-800-345-2550 will help you gearted today. ♪ [ male announcer ] its lightweight construction makes it nimble... ♪ its road gripping performance makes it a cadillac.

10:00 am

introducing the all-new cadillac xts. available with advanced all-wheel drive. [ engine revving ] it's bringing the future forward. good morning, welcome to "squawk on the street," get to the road map this hour. ford coming in with strong monthly sales numbers, now gm's turn. we will bring you those numbers plus a live interview with the top exec at the automaker. >> the gap beating expectations for monthly same-store sales and entering the luxury market with a new acquisition.

10:01 am

costco and macy's beating the street. tell you whether the stocks can beat winners ahead for your portfolio. >> big banks an upgrade from stern ajim we have the analyst behind the move to explain. >> look out for starbucks. actor patrick dempsey has his eye on a coffee retailer. we have the details, coming up. >> general motors out with the december sales numbers. send it out to phil lebeau for details. phil? >> thank you, melissa, the numbers from general motors, increase of 4.9% versus the street estimate of an increase of 1.9%. so, above estimate. bring in curt mcneil, the vp of u.s. sales for general motors joining us from the gm headquarters. curt, better than expected december, seems not just for you guys but the industry as a whole. is it possible december will come in for the industry above 15.5 million and the best month of the year in terms of a sales pace? >> yeah happy new year, phil, we are feeling pretty good about what happened in december.

10:02 am

we still think it's going nobody that 15-4 to 15-7 million unit range for the month. we feel very good where we finished up 5%. >> december always a strong month for the automakers what do you believe is bringing consumers back into the show room now. how much is enthusiasm for the economy slowly improving? how much of this is pent-up demand? what do you put your finger on in terms of what's driving the demand right now for auto sales? >> well, phil, we think it's all of the above. the economic factors are still positive, house, autos have certainly helped lead the charge. december is at this point clay good month for the auto industry. the fact washington made

10:03 am

progress toward the end of the month didn't hurt. we feel good about where we finish. >> curt, the big issue shall. >> go ahead, sir. >> the big issue for you guys is the supply of full-size pickup trucks, 139-day supply at the end of november, way above what the industry wants to see in general. you have cut that down substantially, bringing it all the way down to 80, basically taking almost two full months off the table. a lot of that is because of the incentives. you have certainly goosed the market in that regard, but do you still need to look at potentially curbing production as you guys are gearing up for this next generation of pickup trucks? >> we have tried to be transparent on that issue, phil we do have some down time that's, you know, coming into play when we get ready for our new pickups in the second quart ir. if you look, we had basically the same level of incentive spend that we did a year ago. our transaction prices were

10:04 am

actually up. our best pickup month since september 2008. we feel good where we ended up. >> you don't think you need to cut production? i want to be clear here? >> no, sir. no, sir. no. we feel we are very much on plan. >> curt mcneil, the vp of u.s. sales for general motors joining us first on cnbc from the company's headquarters today. melissa, one other negotiate the end of the year with volt sales topping 23,000, selling more than 2600 in the month of december. i know a lot of people will sit there and say just 23,000 volts? an improvement compared to where they were a year ago but just to give you some per spec istive on where they are with that particular vehicle is. >> phil, before we let you go, think it's important to point out the role that auto sales are having in the u.s. recovery. xred de credit suisse has a lot of coverage. 30% of all economic growth was down to consumers buying automotive vehicles.

10:05 am

extraordinary. >> absolutely. only continuing simon. people will sit there and say we had a huge year in autos is that it? no. look what is expected for next year. industry will finish seams 14.5 million. expected to be 15.5 million next year, another 1 million will be added into the sales growth in 2013. >> wow. >> all right, phil, thank you. phil lebeau. >> you bet. >> markets off to a rough start, after being up the past two trading sessions 90% upside days, back-to-back ones, account rally continue? bring in the chief investment strategist with raymond james. jeff, great to sigh, happy new year to you. >> merry new year. >> merry new year. like that explain what an upside day is and why back-to-back days are important, in your view. >> 90% volume upside days are when 90% of the some volume, total volume trade comes in amount upside and back-to-back 90% upside volume days are pretty rare event he is.

10:06 am

the performance of the stock market following that, about one month later, is higher, 83% of the time. a pretty good start to the new year. >> you think history will be our guide this time around, considering the debate about southwester and debt ceiling comes in about a month, two months' time? with >> what's important that nobody is really talking about is what's happened the past couple of days is that our government has become a little less dysfunctional. >> come on, really sorry. they can't pass the hurricane sandy bill that is not functional government. come on, sir. really, jeff. >> that's the same thing people said when i said i lived inside the beltway and i held onto the naive belief they would come together in the final hour and get us past the ac ka pull co-cliff dive. i think you will find the same thing going forward. i think the republicans are going to turn from trying to

10:07 am

tear down everything president obama's done and actually try and refocus the discussion and try and shape future outcomes of events. >> jeff, you've obviously been around the block before. let me ask you. when you make these historical comparis comparisons, if you're new to the game, you know go, so much different this time you can the fiscal cliff is important or mario draghi saying he was going to do everything to save the eurozone. these are huge events for market so it kind of distorts the run of the mill pattern of what history tends to teach us. was it always this way or are we in a different world now? >> it's probably different at the margin. if you recall backe to the 1974 era, new york city was effectively bankrupt. 1981, '82, mortgage rates, 30-year mortgage rates at 15.25%. le rhythm of the market is human nature doesn't change you can the players do, but human nature doesn't change. i think it is a mistake to get too bearish here.

10:08 am

>> people who say fiscal cliff 2.0, hitting another rough spot that's all hype, you are going to be invested in this market? >> i have been, continue to be. i continue to think that 2013 is going to extend the economic recovery. you saw the housing figures come out the other day. you see the automobile figures come out today and despite those strong figures, the average life of a car in this country is still 12 years. >> so where do you want to be in? >> i think you want to be in technology. i think you want to be in consumer discretionary. i think you want to be in the financials. in fact, i like most of the sectors, except for the consumer staples, because they look expensive to me, and a lot of portfolio managers hiding out in them, worried about the fiscal cliff, euro quake, et cetera. >> jeff what about the small caps? brian was making the point that they have done extraordinarily well that we have risen substantially on those because they are, of course, more exposed to u.s. economy almost exclusively compared to the big

10:09 am

caps, which, as we know, trade around the world as a business. >> this is the start of a new secular bull market earthquake the small and midcaps tend to outperform and i think you should have an overweighting in both those areas. >> interesting. >> jeff, we are gonna let you go. thanks for your time. >> pleasure. >> raymond james. >> new year. send it to michelle caruso-cabrera for a market blast. >> nyg getting hit, jpmorgan went underweight from newt travel. worried about the key cash flow drive others of that company's business, a lot more competitionship. a company that tries to commercialalize genetic test, lower by 4.5%. mygn. back to you.

10:10 am

everything, plus a profit of more than $22 billion. for the american people. thank you, america. helping people recover and rebuild -- that's what we do. now let's bring on tomorrow. and his new boss told him two things -- cook what you love, and save your money. joe doesn't know it yet, but he'll work his way up from busser to waiter to chef before opening a restaurant

10:11 am

10:13 am

rallying, other tech names as wellsome tech the sector to be in for 2013 and will apple still be king? lead analyst for pc mag mobile and analyst for pc mag.com and an analyst from piper jaffrey. thank you for joining us on cnbc. sasha, let me kick off with you. at the beginning of the year, all things seem possible whiz of these events do you think will move the needle for investors, blackberry 10, apple iphone 6 or the launch of a samsung galaxy s 4? >> i think if you think about apple changing their iphone cadence potentially from one product a year to two products a year, which is something we might be seeing, that could be the biggest move for investors. if apple speeds up their product portfolio to counter companies

10:14 am

like samsung that will put a rocket engine under apple there. >> yes, it will get people to buy these products, gene, but my concern as an invest certificate argument to be made is that after, what six months or so, then that's when you start getting savings in terms of sol automatic from any new products you start shortening these cycles you can won't get that scale that they have had with past products. gene? >> a fair concern. if you look at the street estimates for margin, 42% for 2013, 45% for the last cycle. in some ways, guidance about gross mar joins anticipate what you talked about. >> apple doesn't quickly obsolete its older products. the slightly older products become what occupies the lower

10:15 am

cost slot. by speeding up releases, maintaining the older products in the market and achieving mar jirn on them, just reducing their subsidy. air. chiefing margin on them but selling them at a lower cost, the impact net net on margins is lower. doesn't solve the are margin problem, sasha. >> 63% upside from here. does that keep you up at night, gene? are you kind of like, well, maybe the market turned against me now? >> well, when you look at 63%, big gap between then and now, realize that is a big gap. if you look at the numbers and what's coming in 2013 i don't get concerned about that price darket, the reason is this, 20%

10:16 am

plus concern earnings growth the next years. you have the new tv sometime later this year, positive, too. so, when you think 63% a a big number, but you start stepping through the math, it's not that big of a jump. >> gene, are you that confident about apple tv, the full-size television this year? >> we are pretty confident. i would say that if you're going to put a percentage probability on it, we would say there is an 85% chance it happen by the end of this year, i think it's 100% chance it will be in the next two years. this is a function of time this is not an if, this is definitely a win question. you know how people get all excited about apple products and i think this tv's gonna be yet another product that should be positive for the stock. >> you see, where are you, sasha, on this mythical tv? btig just put out the top 30

10:17 am

media predictions for the year and it does not believe that apple tv will be launched in 2013 and kind of caught up in the negotiations and technological problems. i mean, do you think it will come through this year? >> no. i respect a lot of the stuff that james says but he has been predicting this am tv since 2009. and it's been mired in the same problem the entire time, which is that apple will only release a tv if it can be an extraordinary user experience, which mean it is has to be input number one. there has to be no cable box, no cable company layer, sitting between the tv and the user. and the cable companies and the content providers have learned a lot from the experience of itunes them don't want that control taken away from them. so far, that's been an impasse. >> gene? >> we sort of talking about the tv in 2009. we initially said it could be announced at the end of this year in 2013. so just as far as kind of a background there. second is that the content side isn't the critical part, in our

10:18 am

opinion is that that seems to be where a lot of the street's focused on. we think that content is not going to be where the hope of an unbundled channel is but we do think just fixing the basic interface is enough for apple to be -- have a successful tell vision. >> one thing is for sure, going to be a fascinating year. gentlemen, sasha, gene, thank you very much for joining us, happy new year. >> happy new year. the car sales numbers continue to roll out. now, toyota's december figures out. phil lebeau, how are they looking? >> brian, the first auto maker to report today below what we were expecting. toyota reporting an increase in december of 9% for the month of sales. that compares with the street estimate an increase of 13.1%, well belee what the street was expecting in terms of monthly sales from toyota. guys, if we can, call up a chart of -- one-year chart of either ford or general motors or both of them, because after both companies reported better-than-expected sails for the month of december, their

10:19 am

stocks are both nowed a 52-week highs, we were talking earlier, heard you guys talking earlier with jim crime ber ford and the other auto makers, now seeing it with gm and ford, 52-week highs. back to you. >> phil lebeau, thank you for that. still ahead it is a new year, means new year's resolutions are in full swing as people hit the gym and start their 2013 diet plans. nutrisystem is looking to help clients drop the pounds so the company can book profits. the ceo will give us her plan of action, straight ahead. a better place cated to handle your legal needs. maybe you have questions about incorporating a business you'd like to start. or questions about protecting your family with a will or living trust. and you'd like to find the right attorney to help guide you along, answer any questions and offer advice. with an "a" rating from the better business bureau legalzoom helps you get personalized and affordable legal protection. in most states, a legal plan attorney is available with every personalized document to answer any questions. get started at legalzoom.com today. and now you're protected.

10:20 am

[ male announcer ] how can power consumption in china, impact wool exports from new zealand, textile production in spain, and the use of medical technology in the u.s.? at t. rowe price, we understand the connections of a complex, global economy. it's just one reason over 75% of our mutual funds beat their 10-year lipper average. t. rowe price. invest with confidence. request a prospectus or summary prospectus with investment information, risks, fees and expenses to read and consider carefully before investing.

10:22 am

welcome back, michelle caruso-cabrera at the market desk. retailers, december same-store sales, better than expected for at least some, widespread from the high end, nordstrom, to discounters like ross. also raising its outlook for the earnings for for the fourth quarter, tjx, last month's 4 1/2% increase, coming on top of the growth a year earlier, helping to offset the only 1.6% rise logged for november. brian, back to you. >> thank you very much. out with the old, in with

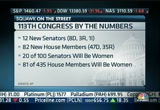

10:23 am

the new members of the 112th congress meeting the last time. 1913th congress sworn in later today around noon eastern time. eamon javers live in washington with the issues the new congress is facial. what isn't it facing? >> a lot here, welcome to washington for the new class of republican freshmen and democratic freshmen as well. very different congress we have seen in years past, a big group of new folks, look at the 113th congress by the numbers. what you will see is we have got 12 new senators, eight democrats, three republicans and one independent. that's angus king from the state of maine. 82 new house members 47 democrats, 35 republicans. 20 of the new senators will be women. 81 of the 435 house member he is will be women and filled with familiar and ambitious faces, including two presidential candidateses or possible presidential presidential candidates, in 2016, paul ryan,

10:24 am

the budget chairman in the house of representatives and marco rubio, the republican senator from florida both viewed as possible contenders for the gop nomination in 2016. also, elizabeth warren somebody that wall street is going to be keeping a very close eye on, a reformer. she was influential setting up the consumer financial protection bureau, somebody to watch as well is tim scott, the first african-american republican in the senate in decades. he was appointed by the state of south carolina's governor, nikki hail tloirks take over a senate seat there. somebody who everyone in the national media is going to be paying a lot of attention to. when they get here, they are going to have focus on a host of huge issues, include you can the debt ceiling, gun control, immigration, on and on and on. brian, not going to be easy for these folks. they have got a whole wide range of issues. >> i see for the first time ever, white men will now be in a minority amongst house democrats. let me ask you about speaker boehner, because two years ago

10:25 am

when he came through as speaker, he was the toast of washington, you know, riding that tea party wave. now, he seems to be a man very boxed in, not just for the fiscal cliff but the aftermath of the inability to vote on hurricane sandy. what future for him? presumably, he keeps his job. >> presumably, he does. the immediate future for him, he faces an election for speaker of the house today. a few rumblings of people unhappen on the republican side with john boehner as their speaker but there are very, very few people in this town who think these going to lose that election later today. he is expected to win and be reinstated as speaker for the 113th congress. you are right. he has had a very tough week. add very tough battle yesterday with republicans over hurricane sandy spending, this whole debt and deficit issue very tough for him as well with these negotiations with the president. we will have to see john boehner in the 113th as well. >> eamon, thanks very much, see you soon. >> check on the housing market now, fiscal cliff fears driving

10:26 am

a major jump in sales in manhattan. diana olick has details. short supply, i read? >> short supply bus no question, simon. this is one of those markets may be giving a big thank you to sales of the fiscal cliff. sales of co-ops and condos jump 40% from a year ago. and according to another report today, they haven't seen the number of sales in q 4 this high in over 25 years. again, saying it's fears of the fiscal cliff. i got off the phone with jonathan miller of miller samuels do ho does the year-end report, the jump in sales was a function of proactive tax management by property owners. even though they didn't know what was coming ahead. now, of course, the seams were largely on the high end, the luxury end of the market, which represents the top 10% of the manhattan market. the average prices mr. skewed very high there to 1.3 million dollars. the three bedroom and larger co-s on saw a 34% price leap in

10:27 am

the average prices. now, when you look at the median, however, which is half of them sold for higher and half of them sold for lower, you did not see those kind of price gains. this tells you it was the real high-end properties that were selling the most on fears of the cliffs. as you said, inventory is very low. not seen inventories this flow over 12 years that will keep prices higher going into 2013 but they are warning that in the first part of the year, you may see a drop in sales and prices because so much demand was pulled forward. melissa? >> diana olick, thank you very much. as you know, tomorrow is the big december jobs report. that means another opportunity for you to nail the number. tweet us your predictions for the december non-farm payrolls figure, our handle at squawk street, #nail the number. this month's prize is pretty amazing. >> it is. amazing. >> ocd, very amazing. >> i personally enjoy notebooks but it is a notebook autographed by the "squawk on the street" team. >> she means a paper notebook, doesn't mean a computer? >> oh, yes e.

10:28 am

>> this notebook here. >> old-fashioned notebook. >> if off stationery feddish, this would get you going. >> we will all autograph it you have got until one minute before the friday release of 8:30 a.m. to enter. so -- >> you can be an honnary signatory. >> i would rather enter because i'm not officially a member of "squawk on the street." whatever your number, i'm one job above your number. >> there are strict rules. look at this strict rules. >> 18 or older, too. >> thanks for destroying my dream, simon. my only goal of 2013. now dead. >> nail the number. >> a lovely book, by the way. still use paper around pen. >> i do >> goldman raised their estimate for the non-farm payroll to 200,000 from 175 about an hour ago. so, goldman, more optimistic on that number now, maybe you want to use that in your guess sometimetion to win that lovely

10:29 am

notebook signed by all schism not forge carl's name or signature. that was a bad joke. >> pristine still. >> still to come on the program, financials pulling back a bit today after clocking in as the biggest -- the best -- financials the best performing sec nor 2013? apparently so. with dedicated support teams at over 500 branches nationwide. so when you call or visit, you can ask for a name you know. because personal service starts with a real person. [ rodger ] at scottrade, seven dollar trades are just the start. our support teams are nearby, ready to help. it's no wonder so many investors are saying... [ all ] i'm with scottrade.

10:30 am

it's no wonder so many investors are saying... i've always kept my eye on her... but with so much health care noise, i didn't always watch out for myself. with unitedhealthcare, i get personalized information and rewards for addressing my health risks. but she's still going to give me a heart attack. that's health in numbers. unitedhealthcare.

10:32 am

>> hormel foods announcing it would buy skippy from unilever for $700 m skippy clocks in the leading brand in china and sold in more than 30 other countries on five continents. retail same-store sales for december showed mixed bag of results, costco, gap and macy's the brightest spots, target and limited brands disappointed. two top-rated analysts join us with their insight. begin with you you ed, your take

10:33 am

away on the numbers we have seen so far today. >> definitely a mixed holiday. lots of things at play. hurricane sandy. long period between christmas and new year's. we think nordstrom is a clear winner this holiday. >> what was a clear win, ed? >> we think nordstrom was. >> nordstrom? and was that at the expense of, say saks and neiman marcus or all three do well? >> the consumer has lots of challenges, one thing with nordstrom, a very high penetration in california and california seems to be getting better. >> give us some of your winners and losers, clear numbers that we have seen so far in december, brian? >> yeah, so very disappointing month for most of the mall-based retailers. trafficville challenging, people shopping online now. off the mall is where we saw people win.

10:34 am

urban outfitters, off the mall, urban outfitters and anthropology concepts driving strong concepts, unique concepts, we think urban the big winner this year. >> we need -- when we talk about the high-end consumer, it's size to say the high-end consumer this and that but seem there is a real delineation between which retailers are able to attract consumers, you look at nordstrom, a bright spot, posted good numbers, you guys both like it you luke at coarse, executing, seems to be holding up valuation basis, trading at a high valuation, luke at tiffany's what's wrong with a name like tiffany's? >> yeah, i think it all boils down to their vir jewelry business right now. you know, price points below $500 is really where the company's struggling. that's their highest gross margin. if they can't fix that part of the business, you know, the operating margins you can the long-term cash flow could be

10:35 am

somewhat impaired, but i think that's really the big issue now, that's spir racial consumer that was shopping tiffany's silver jewelry a couple years ago, they have gone away and just not clear where they are shopping or if they are going to come back. >> can i take you back to nordstrom? what could we learn there about what is working, apart from the fact they got a concentration on the west coast, we can extrapolate out to other retailers? i'm looking to buy retail for 2013 based on those getting it right and hitting what people want to buy, what does nordstrom tell me? >> one of the things that nordstrom really focuses on is turning inventory very quickly, bringing in fresh new merchandise. women's apparel was cited as strength at nordstrom during the month. one of the other name wes look at that did not report this morning was francesca's collections, has a similar type look to nordstrom at a much lower price point. >> who's going to be a clear loser out there, brian? you said the mall-based

10:36 am

retailers, went through a couple of names. i guess you know you don't cover the malls, can we assume the simon property groups of the world would also be loser it is traffic was bad and hurt the stores? >> well, look, we are several years into the about and c malls struggling, you know, e-commerce up to 10% of most companies, retail sales right now. outlet shopping obviously has become a huge big trend. so i think the traditional mall, you know, is in multiple years now of the downturn, really the a and b-plus volume malls is where the action is. i wouldn't be surprised if you see 300-plus malls close. >> 300 malls close? >> yeah, over the next five to ten years, if e commerce and mobile commerce really becomes 20 or 25% of retail, which we think it will be the next ten years, not going to need a lot of these c and d malls a lot of

10:37 am

capacity out there. >> where do they close? geographically, where are they most likely to close? >> i think it's pretty broad based. the downturn in florida and california probably had most people spooked, but you could see a broad-based 300 of the worst performing malls some time in the next ten years take a deep look at why they exist. >> to take it another step if those malls, those lower end malls, weakest performing malls close, what are the retailers most likely to shrink the footprints? >> you look at names like aeropostale, a very high store count, somebody struggling, like a wet seal, clearly the team players in some of the more marginal malls we think are at some degree of risk, and brian's comment, online so important to so many retailers and some haven't made the critical investments necessary to drive those businesses. what we need is more half-empty strip malls in this country.

10:38 am

ed and brian, thank you very much. we appreciate it. as we head toward the break, look at where we are on the markets there is some profit taking here almost 500 points on the dow in two section. yes there is euphoria, all right euphoria continue or was that just a short-term relief rally? ahead in the program, bond bubble or no bond bubble? >> that is gary kaminsky's question of the day? who better to ask that of than the bond vigilante jeffrey gundlach who will join us ahead in the program. we are back in two this is cnbc. mine was earned off vietnam in 1968. over the south pacific in 1943. i got mine in iraq, 2003. usaa auto insurance is often handed down from generation to generation. because it offers a superior level of protection, and because usaa's commitment to serve the military, veterans and their families

10:39 am

10:40 am

it's part of what you love about her. but your erectile dysfunction - you know, that could be a question of blood flow. cialis tadalafil for daily use helps you be ready anytime the moment's right. you can be more confident in your ability to be ready. and the same cialis is the only daily ed tablet approved to treat ed and symptoms of bph, like needing to go frequently or urgently. tell your doctor about all your medical conditions and medications, and ask if your heart is healthy enough for sexual activity. do not take cialis if you take nitrates for chest pain, as this may cause an unsafe drop in blood pressure. do not drink alcohol in excess with cialis. side effects may include headache, upset stomach, delayed backache or muscle ache. to avoid long-term injury, seek immediate medical help for an erection lasting more than four hours. if you have any sudden decrease or loss in hearing or vision, or if you have any allergic reactions such as rash, hives, swelling of the lips, tongue or throat,

10:41 am

or difficulty breathing or swallowing, stop taking cialis and get medical help right away. ask your doctor about cialis for daily use and a 30-tablet free trial. financials booking big gains in 2012 and one analyst is making the call to upgrade citi and jp morgue ton a buy today. is there more room to run in the trade? todd, good to see you, good to

10:42 am

see you. >> happy new year. good morning to you. >> i want to ask about the citigroup upgrade. that is interesting. one primary reason, according to your note, is mike corvath, you said he is a game changer. mike core bat has been there about three months and the stock has run up about 20%. why now? why not before? >> you may recall, we did downgrade the stock in the late fall essentially the frustration with the progress over the holdings. more importantly, we think this

10:43 am

is just the beginning of a number of different repositioning actions that mr. core bet is going to take the next several morns, which we think will further, you know, help lift the stock over the course of the next six to 12 months it certainly has a lot more room to run from here, in our view. >> you mentioned the bank regulators, obviously, a lot of investors in this space are looking forwarded to stress tests and ability to return capital important completion of those. your counterpart at suntrust cut morgan stanley to reduce and generally said that there's toofrp expectation behind some of these stress test and the ability to return capital. for the case of citi and jpmorgan specifically, do you think too much baked in by the part of investors, too much in the stocks because there's an anticipation that the buy backs lynn cease or the dividends will increase? >> i don't think the expectations are too high, particularly with both city and jpmorgan. it's certainly, you niece little

10:44 am

bit different, you move across-the-board, the different companies jpmorgan, the concern over 2012 was the regulatory risk and the overhang associated with the cio trading loss back in the spring. we have become more comfortable that risk has subsided going into the new year and in fact, as you look at the cap levels of jpmorgan, we certainly expect them to be able to return excess capital to shareholders through a buy back and dividend increase, nothing as robust as 2012, but a fair amount of capital, which i think will go over well investors. citigroup, by the same token, very well positioned to finally start to return a more meaningful amount of capital to shareholders, in particular, the restructuring that they just announced here a couple week he is ago sets them up very well going into the stress test in

10:45 am

march, improving their revenue trajecto trajectory, helping them on the basal 3 front, particularly as the salomon smith barney vv close quarter. all is incremental positive for citi and cap return to hit share the first quarter. >> before we let you go, todd, just to put a context on this you write that the average growth you expect or the price targets imply price appreciation of between 13 and 17% during the course of the year, depending on which of the pick it is. this is going to be a very different experience in terms of price action for the banks in 2013 compared to 2012. why is that? >> >> as we approach the end of 2012, we have concerns over the fiscal cliff, volatility day to day as it relates to that issue. over the next couple of months with dough have the ongoing budget discussions, which we

10:46 am

think, again, will create a fair to amount of volatility within the sector. that being said, we are recommending to investors take advantage of that volatility, buy on the dips, accumulate your position, because there's certainly a lot more upside in these names as we go forward. but certainly a strong run but there's more room to go. >> todd, last question here, and this struck me as very interesting, within your citi upgrade, you mentioned equity tradings up 15%some that just for citi or expect an across-the-board increase in equities trading volumes? >> no i mean, it's fairly unique for the different companies. certainly for fourth quarter earnings, capital markets-related revenues not expected to be anything robust or anything to write home about, quite frankly. but for the most part, each of the companies should be down, let's call it on average roughly 20% quarter on quarter.

10:47 am

you remember back to a year ago, it was a pretty dismal year end. so everybody should be up on a pretty healthy basis relative to the year ago period. >> easy comps. todd, good to see you. thank you. >> thank you. and now to one of the burning questions of the morning, what does actor patrick dempsey want with a coffee company? >> i was just asking myself that. >> what do they call him, mr. -- >> no, dr. mcdreamy. on "grey's anatomy." >> i hear jane wells, maybe she has the answer to that question, what does dr. mcdreamy want with a coffee chain? good morning? >> i tell you, i don't care what he wants, i'm gonna report on t as shocking as it may sound, simon, not every coffee company to come out of seattle has turned out to be a winner. tully's filed for chapter 11 in october, nearly $4 million in debts. this is for its brick and mortar stores, also agreement with franchisees and coffee sold in grocery chain. its wholesaler and roasting operations sold to green mountain a few years ago.

10:48 am